Education Loan Terms and Conditions – Nowadays, students are moving abroad to make their financial background solid enough to get the best opportunities in their career prospects. Be it graduation, post-graduation or any other summer courses. If you are one of those students, you must look after the student loan and if you are eligible. When applying for a university abroad, you have to start thinking about how to fund your education. And if you are planning to finance your education, you must know some of the vital education loan terms and conditions for student loan eligibility. Knowing all the terms would help you understand your loan process seamlessly to save some money.

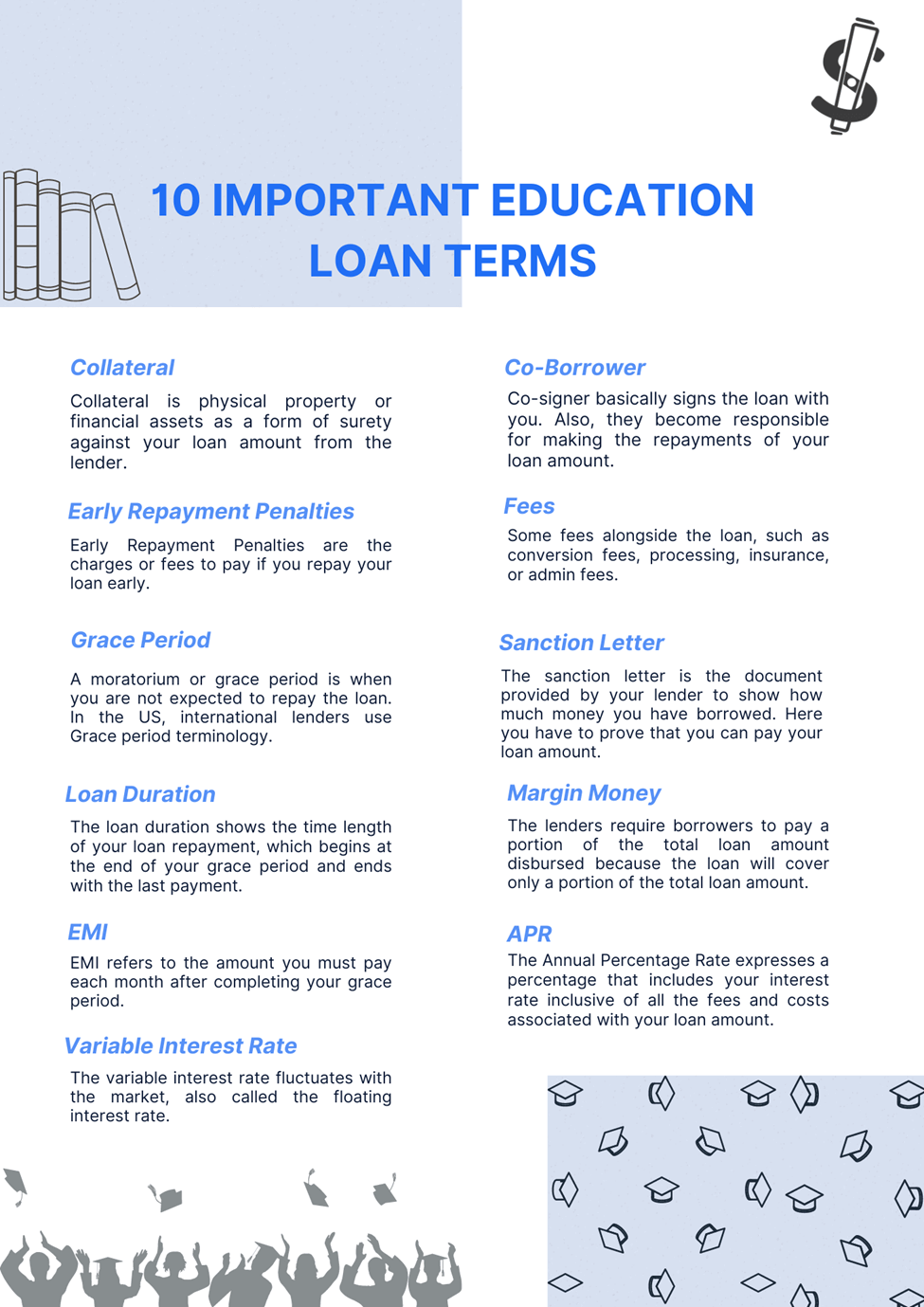

1. Collateral

Collateral is physical property or financial assets as a form of surety against your loan amount from the lender. This is a common term while applying for a loan.

Collateral is essential because if you fail to repay your loan, your physical property or financial assets will be seized.

In countries like India, the collateral amount is higher than the loan amount. However, if you are planning to study in the UK and US, you may not require the collateral. Cross-border and international lenders may also not need any collateral.

2. Co-Borrower (Co-Signer)

As the name suggests, the co-signer basically signs the loan with you. Also, they become responsible for repaying your loan amount. In India, the co-signer is often known as a co-borrower; it means something else in some countries like the US and UK.

Having a co-borrower for your loan amount gives your lender a surety that they can get the money recoupment, usually at a lower interest.

In India, the loan amount is possible without collateral if you have a strong co-borrower. Also, for an international student, it is necessary to have a co-borrower in the host country.

3. Early Repayment Penalties

Sometimes, you are available with the required amount and must know the repayment penalties option available.

Early Repayment Penalties are the charges or fees to pay if you repay your loan early.

In this scenario, the money lender would earn the money by taking the loan interest amount.

These early repayment penalties only happen sometimes because most banks do not cut any fees or charges. But some finances charge some interest money on the outstanding balance. Also, if you repay the amount early, then you do not need to pay anything extra if there is no clause mentioning the early repayment terms and conditions.

4. Fees

While taking a student loan, you have some fees alongside the loan, such as conversion fees, processing, insurance, or admin fees.

Some banks and lenders are quite transparent about the fees they charge for processing your application. Otherwise, some are not.

When and how much amount is charged can vary between lenders or banks.

5. Moratorium Period (Grace Period)

A moratorium or grace period is when you are not expected to repay the loan. In the US, international lenders use Grace period terminology.

The interest amount is still applied to your loan during the grace period. Understanding the grace period and the interest rate can help you choose between your loans. Finally, it can give you some time to arrange the loan amount.

The interest on the grace period is compounded. The grace periods usually last up to six months after completing the full-time course.

6. Sanction Letter or Loan Confirmation Letter

The sanction letter is the document provided by your lender to show how much money you have borrowed. Here, you have to prove that you can pay your loan amount.

The loan confirmation letter is essential as it will help you to get your study visa. Some lenders may charge some fees to release the loan confirmation letter.

7. Loan Duration or Loan Tenure

The loan duration shows the time length of your loan repayment, which begins at the end of your grace period and ends with the last payment.

The longer loan tenure lowers the interest rate. You will pay more over time. There is no international loan tenure norm. You can expect between seven to twenty years.

You can look for lenders that can offer you flexible terms so that you can select your timeframe for loan repayment.

8. Margin Money

Sometimes, lenders require borrowers to pay a portion of the total loan amount disbursed because the loan will cover only a portion of the total loan amount. In India, the money paid to the lender before being returned as part of the loan is called margin money.

The margin money is the amount you need to pay your lender to get your loan, as you will know how much money is left and how much fees are included. In India, financial institutions have certain terms and conditions regarding the percentage of margin money that the borrowers have to bear. However, it is rare to find in countries like the US and the UK.

9. Estimated Monthly Installments (EMIs)

EMI refers to the amount you must pay each month after completing your grace period.

Each borrower has a different monthly payment based on their loan tenure and the variable interest rate; the actual amount varies monthly.

Bonus Terms

1. Variable Interest Rate

The variable interest rate fluctuates with the market, also called the floating interest rate. Your minimum monthly due in VIR changes according to your interest rate changes.

VIR is primarily available for private education loans that align with current market rates. Some lenders offer loans at floating rates, and others offer at fixed interest rates. Be sure to check the interest rate terms and conditions of your student loan

2. Annual Percentage Rate (APR)

The Annual Percentage Rate expresses a percentage that includes your interest rate inclusive of all the fees and costs associated with your loan amount. This amount is usually higher than your interest rate.

APRs are usually used in place of interest rates because it shows the effect of the fees on the cost and the interest rate. It is more accurate than the interest rates.

In the US and UK, the lenders must provide their APR because they abide by the laws to avoid hidden fees.

What is Education Loan Eligibility Criteria?

- He/she must be an Indian citizen.

- A person is eligible for an education loan terms and conditions if they fall in the age group of 18 to 35 years in their student loan application.

- Must undergo graduate or postgraduate degree.

- Must secure admission to college or University affiliated with UGC/AICTE/Govt, etc.

How to Find the Right International Study Loan?

Once you have the basic eligibility, it is time to look after the lender who can give you the loan. The best advice we can give you is to explore all your options, check their terms and conditions for student loan carefully and then decide.

- Lender from your host country

- Banks

- International Loan Providers

Documents required to apply for a student loan to study abroad

- Identity proof for name and date of birth, such as passport, Adhar, PAN card, etc.

- Proof of residence, like a rent agreement, a title deed, electricity bill, etc

- Proof of relationship with the co-applicant like marriage certificate, Adhar card, legal heir certificate, etc

- Academic documents like 10th, 12th, and graduation (if applicable) mark sheets, entrance test scorecards, and registered certificates for professionals.

- Income proof like salary slips, ITR filings for self-employed individuals, bank statements, Form 16

- Proof of admission, such as your admission offer letter and fee structure.

- Legal documents for collateral – title deed, patta/ khata, property tax receipts, etc.

Conclusion

When you go for your education loan, knowing the terminologies for your education loan terms and conditions is essential. This blog will help you understand the vital terminologies for your education loan. Are you still searching for which University will be best for you? We have launched our SMS Plus, where we provide career counselling to students so that they can choose their dream university.

FAQs About Education Loan Terms and Conditions for Student Loan Eligibility

1. What are the terms and conditions of student loans?

The loan repayment has to be done in between 5 to 7 years.

2. What are the criteria for getting an education loan?

- Identity Proof

- Residence Proof

- Good Academic Record

- Proof of Admission

- Schedule of Expenses

3. What is the minimum salary of parents for education loans?

Either of the parents earning at least 30,000 per month are eligible to name as a co-applicant for an education loan. Therefore, these are the student loan terms and conditions.

4. What are the rules for education loan repayment?

The education loan EMI repayment starts after the completion of the course or after 6 months of employment. Sometimes, it begins after the grace period ends depending on where you have got the education loan.

5. What is the principle of a student loan?

The principle refers to the sum of the money lent on which interest will be paid.

6. What is the limit of an education loan?

For studying abroad the education loan is Rs. 150 lakh, and for studying in India it is Rs. 125 lakh. No need to provide collateral for education loan up to Rs. 40 lakhs.